Why Do Customers Leave? Churn Analytics to contain the leakage

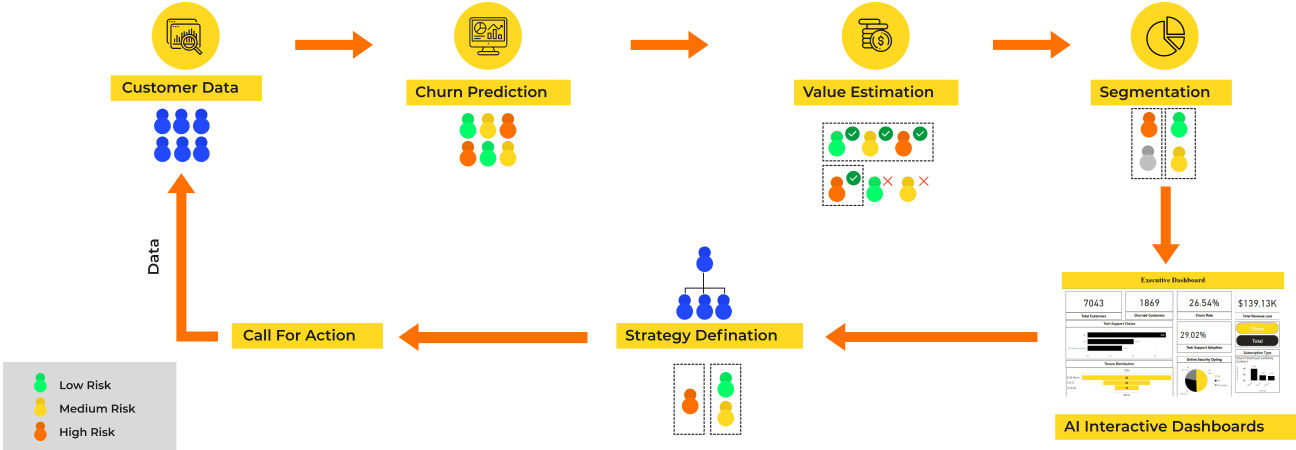

Proactively identify and address the root causes of potential customer churn to prevent revenue loss and foster long-term customer loyalty.

was observed with a 5% reduction in customer churn

Take Control of Customer Churn and Drive Sustainable Growth. Request Your Brochure Today.

A SaaS company reduced customer churn by 5%, leading to a 70% increase in overall customer lifetime value. Predictive analytics identified at-risk customers, enabling targeted retention strategies.

See how analytics can transform your business and maximize retention with our churn analytics insights.

Get Your Brochure Now

Measures customer satisfaction with a product or service.

Low CSAT scores can indicate dissatisfaction, which is a key driver of churn.

Estimates revenue a customer will generate.

A low CLTV : CAC suggests that customers are not generating enough value to offset acquisition costs, potentially contributing to churn.

Measures customer loyalty and willingness to recommend a product or service.

Low NPS scores suggest a higher likelihood of churn as customers are less likely to remain loyal.

The customer health score is a metric used to understand the likelihood of a customer to grow, stay consistent, or churn.

A low Customer Health Score can indicate a higher risk of churn. It can help you proactively reach out and help solve the issues.

Measures the cost of acquiring a new customer. High CAC relative to customer lifetime value can indicate a less profitable customer base, potentially leading to higher churn rates.

Our cohort analysis tool segments customers based on behavior, subscription dates, and usage patterns, allowing you to track churn trends across different groups.

This helps in identifying the exact stage where churn risk peaks, enabling targeted and timely interventions to retain customers. Gain clarity on which actions to take based on real-time insights.

We help you assign a dollar value to potential churn by calculating both the likelihood of churn and the revenue impact of each customer.

This allows you to prioritize high-value accounts that are at risk, ensuring that your retention efforts are focused on the areas that matter most to your bottom line. Maximize the efficiency of your retention strategies by acting where it counts.

Our platform is designed to integrate seamlessly with your CRM, billing, and product usage systems. We can pull data from various sources to create a unified view of customer behavior.

Yes, using advanced machine learning models, we analyze multiple data points such as product usage, support interactions, and billing patterns to pinpoint the key factors contributing to churn.

Results can typically be seen within the first 30-60 days, with early insights around churn risk factors emerging even sooner. Ongoing monitoring will provide actionable recommendations to improve retention.